Capital Funding for Rural Healthcare

The ability of a healthcare facility to meet the needs of a rural patient population is directly related to the efficiency, size, and quality of the facility and its equipment. In addition, updated facilities and equipment impact the ability of a rural community to recruit and retain health professionals, improve patient safety, expand services, and increase satisfaction rates.

Capital funding sources allow for investment in healthcare infrastructure, including the construction, renovation, and expansion of rural healthcare facilities. The purchase and installation of major equipment and technology are also considered to be capital investments. Finding funding for capital projects is a major concern for many rural healthcare facilities. Due to lower patient volume and the increasing healthcare needs of rural communities, most facilities operate at such tight margins that capital projects get put aside, leading to deteriorating and outdated physical plants and equipment. Without lower cost capital options, many rural facilities would not be able to maintain the quality of services or the safety and maintenance of their facilities while keeping costs at an affordable level and facility operations sustainable.

The needs for healthcare capital are many in rural communities. Many small rural hospitals were built in the Hill-Burton era of the 1940s and 1950s. Faced with aging and inadequate infrastructure, hospital leaders must consider and undertake major capital projects such as renovation or replacement of the facility. In addition to bricks and mortar, capital projects may include patient redesign, which includes facility design elements and equipment needed to manage patient flow, enhance infection control, and reduce patient stress. In recent years, another pressing capital funding need has been the purchase and installation of electronic health records and telehealth systems, which can add significant hardware, software, implementation, and data compilation costs.

Successfully funding a capital project can require blending multiple sources and types of funding, including public grants and low-interest loan programs, as well as private sources such as foundations, local donors, and traditional lending sources. Blending funding sources can be especially effective for larger projects, such as hospital building and major renovations.

While there is a lot of complexity and many steps to acquire capital for a facilities project, it is critically important to start with an understanding of how the proposed project is connected to the changing healthcare needs of the community and the industry trends of population health. In addition to this kind of strategic planning, successful organizations plan up front regarding their debt capacity and operational needs. Get connected with partners that can help set you up for success early in the planning process. If needed, hiring a consultant or financial advisor early in the process can ensure that projects are feasible and planning dollars are spent wisely.

This guide brings together resources for running successful capital campaigns and provides information on current capital funding needs of rural hospitals, clinics, and other providers of healthcare services. This guide also lists federal, state, foundation, and community development finance funders that are interested in supporting capital projects.

Frequently Asked Questions

- What types of low-interest loan programs are available to rural healthcare facilities for capital investment projects?

- What are the major federal grant programs that support capital projects for rural healthcare facilities?

- What is a loan guarantee and how can it help fund a capital project in a rural hospital or clinic?

- What is an Essential Community Facility and how can it help rural healthcare facilities access capital?

- What is the Community Development Block Grant (CDBG) Program and how can it help rural facilities?

- Do foundations support capital projects?

- Can for-profit healthcare facilities apply for grant funds, or are only nonprofit organizations eligible?

- What other avenues of funding are available to finance capital projects for rural healthcare facilities?

- What is a Community Development Financial Institution (CDFI) and how do they help rural healthcare facilities?

- What are some strategies for seeking out capital funding?

- What are some strategies for running a successful fundraising campaign for capital projects?

- What is a capital stack, and how do you build one?

- Are there funding programs that specifically support electronic health record implementation or telehealth projects in rural healthcare facilities?

- What are State Health Facilities Finance Authorities, and how can they help with capital funding?

What types of low-interest loan programs are available to rural healthcare facilities for capital investment projects?

USDA Rural Development tends to be the most available capital resource for rural healthcare facilities. USDA offers programs that provide low-interest loans and limited grants for capital funding. A brief description of those programs is below. Contact your local USDA Rural Development state office or a USDA guaranteed lender to discuss which loan product is the best fit for the project.

- Business and Industry Guaranteed Loans can be used to purchase and develop land or equipment, or for expansion or renovation costs. Proposed projects must improve employment and economic conditions in rural communities.

- Community Facilities Direct Loan and Grant Program offers loans for construction, expansion, renovations, or the purchase of equipment for essential community facilities. Eligible applicants include public bodies, community-based nonprofits or Indian tribes, for projects located in communities with populations up to 20,000.

- Community Facilities Guaranteed Loans can be used to construct, enlarge, extend, or otherwise improve essential community facilities, including through the refinancing of existing debt, in communities with populations up to 50,000.

- Rural Economic Development Loans and Grants can be used by healthcare facilities for construction or the purchase of medical equipment.

- Intermediary Relending Program can be accessed by organizations to lend for healthcare and other community and economic development activities.

Small Business Administration (SBA): SBA has staff who focus on working with businesses in rural communities. SBA assistance includes:

- 7(a) loans for real estate, equipment, inventory, working capital, refinancing business debt, and purchasing a small business. (See the Lender Match tool.)

- 504 Certified Development Company loans that provide competitive fixed-rate financing for purchasing/renovating real estate and buying heavy equipment for small businesses. (See the Local Assistance tool.)

- Microloans from $500 to $50,000 through a Microloan Intermediary to cover working capital, supplies, equipment, furniture, and fixtures. Businesses may also access free business counseling. (See the Local Assistance tool.)

Small Business Development Centers offer individualized business counseling, training, and technical assistance for small businesses in their regions. Use the tool on the program page to search for assistance by zip code.

There may be other types of low-interest loan repayments offered at your state or local level — see Funding and Opportunities by Topic: Capital Funding. RHIhub also offers free customized funding searches — email info@ruralhealthinfo.org for assistance.

What are the major federal grant programs that support capital projects for rural healthcare facilities?

When healthcare facilities undertake a capital project that will require significant fundraising, grant programs can play an important part in achieving a monetary goal. While healthcare facilities are eligible for many grant programs, the majority of grants available are for programmatic costs and do not allow for purchases of major equipment, construction, renovation, or expansion. It is important to look for programs that specifically state that they will fund capital projects.

Here is a list of federal agencies that fund capital projects for rural healthcare facilities. Please note that the application cycles for these programs may or may not be open at this time.

| Program Name | Eligible Organizations | Maximum Amount | Funding Uses |

|---|---|---|---|

| USDA Rural Development | |||

| Community Facilities Direct and Guaranteed Loans and Grant Program | Public entities such as municipalities, counties, and special-purpose districts, as well as nonprofit corporations and tribal governments in rural areas with populations of up to 20,000 (or 50,000 for the Guaranteed Loan Program) | Grant Maximum: Up to 75% of the project cost Loan Maximum: Up to 100% of appraised value |

Construction, expansion, renovation, or equipment for essential community facilities |

| Rural Economic Development Loan and Grant Program | Local businesses, including healthcare facilities, can apply through local utilities in towns with a population under 50,000 residents. | Up to $300,000 for grants and $2,000,000 for loans | Construction, equipment |

| Distance Learning and Telemedicine Grants | State and local governmental organizations, tribes, nonprofit organizations, for-profit businesses, and groups of eligible entities working together in rural areas with populations 20,000 or fewer. | Between $50,000 - $1,000,000, with a minimum 15% match | Equipment, broadband facilities |

| Administration for Children and Families (ACF) | |||

| Community Economic Development Projects | Nonprofit Community Development Corporations with or without a 501(c)(3) status. (May require a change or addition to the company's charter with regard to economic development) | $800,000 | Expansion, construction In many cases, this funding is tied to the number of jobs created. |

| Economic Development Administration (EDA) | |||

| Economic Development Assistance Programs | District organizations; Indian tribes; states, cities, or subdivisions of states; institutions of higher education; nonprofit organizations | $3,000,000 | Infrastructure, including water, wastewater, telecommunications and roads projects which could strengthen healthcare facilities |

There are many other funders that support capital projects at the state or local level — see Funding and Opportunities by Topic: Capital Funding. RHIhub also offers free customized funding searches — email info@ruralhealthinfo.org for assistance.

What is a loan guarantee and how can it help fund a capital project in a rural hospital or clinic?

A loan guarantee, or mortgage insurance, provides reassurance to a lending institution that if the borrower defaults, a third party (usually a government agency) will agree to pay some or all of the debt owed.

Rural healthcare organizations are more prone to face financial hardships than their urban counterparts and are therefore generally considered higher risks to lenders. Loan guarantees essentially boost the credit rating of a healthcare facility borrower because they provide security to the lending institution. Many federal and state agencies will provide loan guarantees, enabling healthcare organizations to have access to needed capital.

Federal programs that provide loan guarantees for rural healthcare facilities include:

- Healthcare Facility Loan Guarantee, Health Resources and Services Administration, for Federally Qualified Health Centers (FQHCs). Additional information is available from Capital Link.

- 7(a) Loan Program, Small Business Administration

- Business and Industry Guaranteed Loans, USDA Rural Development

- USDA Community Facilities Guaranteed Loan Program, USDA Rural Development

In 2020, USDA launched the OneRD Guarantee Loan Initiative which is designed to increase private investments that improve the economy and quality of life in rural communities through several USDA guaranteed loan programs. Facilities looking for capital funding may seek lenders that provide USDA guaranteed loans or request that local lenders consider participating in the program. Lenders can consult the Lender Help Desk for tools, forms, and USDA contact information.

What is an Essential Community Facility and how can it help rural healthcare facilities access capital?

Essential Community Facilities is a term used by USDA Community Facilities Programs to describe the types of facilities it will fund. Essential Community Facilities must provide an essential public service to the local community which meets all of the following criteria:

- Be a service that is typically provided by a local unit of government

- Be needed for the orderly development of the rural community and considered a public improvement

- Does not include private, commercial, or business undertakings

- Must include significant community support

This source of capital can be useful to rural healthcare facilities because USDA considers Essential Community Facilities to include medical clinics, hospitals, assisted living facilities, police stations, fire and rescue stations, community centers, public buildings, transportation, schools, libraries, and childcare centers — facilities that are essential to the quality of life in rural communities.

Eligible applicants include public bodies, community-based nonprofit organizations, and tribes.

What is the Community Development Block Grant (CDBG) Program and how can it help rural facilities?

The Community Development Block Grant Program is administered by the U.S. Department of Housing and Urban Development (HUD) and works to build strong and resilient communities through community and economic development activities. All CDBG activities must meet at least one of the national objectives: to benefit low- and moderate-income persons; aid in the prevention or elimination of slums and blight; or meet urgent community development needs.

CDBG funds have been used for the following types of projects, which could be beneficial for rural facilities and providers:

- Infrastructure

- Economic development projects

- Public and community facilities

- Public services

- Housing rehabilitation

- Neighborhood revitalization

- Microenterprise (small business) technical and financial assistance

There are multiple CDBG funding programs that may be utilized for health and health-related capital projects in nonmetropolitan areas.

-

The State CDBG Program is a funding

instrument

that allows states to make grants to smaller units of local government. It is sometimes referred to as the

Non-Entitlement CDBG Program for states and small cities. Local units of government across the country use

the funding for projects such as microenterprise loan funds, affordable housing, community facilities, and

sub-grants for community services. Contact information for each state that administers this program may be

found on the grantee

contact page of the HUD website.

Typically, local economic and/or community development departments are knowledgeable about CDBG activities and funding, and they can field questions about available funding in your area. If you are having trouble finding information about funding in non-entitlement areas of your state, contact the appropriate HUD field office. - The Indian Community Development Block Grant (ICDBG) Program is a competitive HUD grant program for eligible tribes and Alaska Native Villages to improve housing, community facilities, and infrastructure, as well as fund microenterprises and expand job opportunities. Consult the ICDBG grant program page for additional information, press releases, past funding announcements, and project activity reports. Regional contact information may be found at the bottom of the HUD Office of Native American Programs (ONAP) page.

- The HUD Administered Non-Entitled Counties in Hawaii Program allocates formula grants in Hawaii, Kauai, and Maui Counties based on population, poverty, and housing overcrowding. Eligible activities and program beneficiaries are listed on the Hawaii CDBG eligibility requirements page. Contact information and past program reports are available on the HUD grantee page under Hawaii County, Kauai County, and Maui County.

- CDBG Colonias Set-Aside requires the border states of Arizona, California, New Mexico and Texas to set-aside a percentage of their annual state CDBG allocations to help provide colonias residents with potable water; adequate sewer systems; and safe, healthy, affordable housing. For additional information, see the Information per State section of the program page above.

-

CDBG Insular Areas Program provides

grants to American Samoa, Guam, Northern Mariana Islands, and the U.S. Virgin Islands to provide decent

housing, a suitable living environment, and expand economic opportunities for low- and moderate-income

persons. Eligible activities and program beneficiaries are listed on the CDBG

Insular Areas eligibility requirements page.

Questions about projects in the U.S. Virgin Islands are directed to the San Juan Field Office, and questions about projects in other insular areas should be directed to the Honolulu Field Office. Contact information is listed on the HUD field office page. - The Section 108 Loan Guarantee Program uses CDBG funds to provide communities with a financing source for economic development, housing rehabilitation, public facilities, and physical development projects, including improvements to increase resilience against natural disasters.

Useful CDBG resources:

- How to Use CDBG for Public Facilities and Improvements video tutorial

- How to Use CDBG for Housing Activities video tutorial

- How to Use CDBG for Public Service Activities video tutorial

- Explore CDBG online technical assistance resource portal

- About Grantees database that includes contact information, reports, awards, and other data for organizations that receive HUD funding

- Basically CDBG Online curriculum

Do foundations support capital projects?

Many foundations do not support capital projects, but they may be available to help with the planning or other parts of the project. It is important to spend some time getting to know the foundation priorities, programs, and guidelines before approaching them about a capital project.

Individual foundations have funding priorities which dictate the types of projects that they will consider. Most foundations typically like to be the "last in" on a capital project. That is, foundations will usually want all other funding secured, and then the foundation will come in with the funds to complete the project.

Examples of private foundations that list capital projects for healthcare facilities as a focus area include:

- Gladys Brooks Foundation – Awards grants in 17 states. Capital funding is listed as one of the types of funding applicants may request.

- Agnes M. Lindsay Trust – Works in 4 states. Focus areas include health and welfare, oral health, and housing.

- Rocky Mountain Power Foundation – Works in 6 states in the areas of community enhancement, safety and wellness, and the environment.

There are many other foundations that support capital projects at the state or local level — see Funding and Opportunities by Topic: Capital Funding. RHIhub also offers free customized funding searches — email info@ruralhealthinfo.org for assistance.

Can for-profit healthcare facilities apply for grant funds, or are only nonprofit organizations eligible?

There are several low-interest loan programs available to for-profit entities but, with very few exceptions, grant funds are only extended to nonprofit healthcare facilities, government entities, or tribal entities. Funders view grants as an investment in social good. Giving grant money to for-profit businesses is unlikely because that would be an investment in one particular individual or set of individuals who stand to monetarily gain from the ultimate success of a venture.

In rare cases, funders may consider a for-profit applicant if it has a strong social mission and is seen as a force for public good. It is important to read through all eligibility requirements prior to applying for funding.

What other avenues of funding are available to finance capital projects for rural healthcare facilities?

When funding a capital project, it is best to gain local support before approaching federal agencies or national foundations. National funders generally have more competitive processes with longer, more time-intensive applications. Many funders also have a matching funds requirement, which can be met by initiating a local fundraising campaign.

Rural communities have a distinct interest in seeing healthcare facilities remain in their area because of the community and economic benefits they bring. For information on demonstrating the economic impact healthcare facilities have on their rural communities, see our Community Vitality and Rural Healthcare guide.

Fact sheets, reports, and toolkits on federal financing resources and capital project planning and financing are available on Capital Link's publications page.

Community fundraising campaigns can be an effective way of raising funds with the proper strategy and a dedicated committee. Approaching organizations and individuals within the community can be helpful to achieving a successful fundraising goal.

Consider involving:

- Local businesses and business organizations

- Local locations of larger companies

- Major employers

- Schools, school boards, and post-secondary institutions

- Chambers of commerce

- Economic development organizations

- Local human resources groups

- Nonprofit housing developers

- Local banks or lending institutions

- Elected officials and city staff

- Local CDFIs and community loan funds

Fundraising letters to individuals and businesses, special events, and planned giving are several strategies to achieving a fundraising goal. Local government agencies may also be able to assist in implementing a dedicated tax levy or award grants or make loans to support the project.

What is a Community Development Financial Institution (CDFI) and how do they help rural healthcare facilities?

Community Development Financial Institutions, or CDFIs, are financial institutions that have community development as their primary mission and that develop a range of strategies to address that mission. CDFIs provide comprehensive credit, investment, banking, and development services. Some are chartered banks, others are credit unions, and many operate as self-regulating, nonprofit institutions that gather private capital from a range of investors for community development or lending. CDFIs make loans and investments and provide basic financial and development services to people and institutions that, for various reasons, are unable to get these services from conventional financial institutions.

CDFIs get capital from many different places, such as private investors, public entities, and philanthropic organizations. CDFIs serve communities throughout the United States that are working on economic and community development, such as affordable housing developers, small business owners, community groups, and other nonprofits or social service providers.

The U.S. Department of the Treasury CDFI Fund administers several funding programs that may benefit rural healthcare facilities:

- The New Markets Tax Credit Program (NMTC) provides options for the capital needs of rural healthcare organizations. The program provides tax incentives for investments for projects in distressed rural or urban counties that will spur economic growth, including capital investments in healthcare facilities. The program is open to CDFIs and organizations that are not CDFIs. Investors give to Community Development Entities which then offer low-interest financing to businesses and nonprofit organizations. New Markets Tax Credit deals are complex; facilities will want to work with an experienced consultant.

- The Capital Magnet Fund (CMF) provides grants to finance affordable housing and community revitalization efforts that benefit low-income people and communities. Community facilities that have been funded under the program include health clinics, senior housing, wellness centers, and oral health facilities. The program is open to CDFIs and organizations that are not CDFIs.

- The Community Development Financial Institutions Program is federal funding that allows CDFIs to provide affordable financing and related services to low-income communities and populations that lack access to affordable credit, capital, and financial services. The most recent list of CDFI funding awardees is provided in the FY 2024 CDFI Program Award Book.

- The Native American Community Development Financial Institution Assistance Program (NACA) provides funding to build the community development capacity of Certified Native CDFIs, Emerging Native CDFIs, and Sponsoring Entities, and to increase access to capital in Native Communities. The most recent list of NACA funding awardees is provided in the FY 2024 NACA Program Award Book.

- The State Small Business Credit Initiative allocates funding to states, territories, and tribes to support small businesses and entrepreneurs. Many jurisdictions are partnering with CDFIs to match and distribute the funding through small business loans. Access a list of SSBCI capital programs and contacts on the Treasury Department website.

The Opportunity Finance Network (OFN) is a national membership network of CDFIs that works to provide high-impact investments in distressed communities. OFN maintains a CDFI Locator tool that allows you to search for member CDFIs with service areas that match your location. The Treasury Department maintains a searchable database for looking up lenders, investors, and technical assistance providers with CDFI certification or Treasury funding.

For additional information, the Rural Monitor article CDFIs "Make Dreams Come True" by Creating Opportunity in Rural Spaces provides an in-depth look at CDFIs, philanthropy groups, and the impact they are making in the rural health arena.

Examples of CDFIs that have invested in rural healthcare facilities include:

- Community Health Center Capital Fund – Supports rural community health centers across the U.S. with operating and capital projects through direct lending and New Market Tax Credits. Capital Fund provides the New Markets Tax Credit Preparation Program, which is no-cost initial eligibility determination and other technical assistance for health centers that are considering New Markets Tax Credit financing.

- Fahe – Works with leadership, housing, education, health, and economic development in an effort to eliminate poverty in Appalachia.

- Hope Enterprise Corporation – Works to strengthen communities in the Delta and other economically distressed parts of Alabama, Arkansas, Louisiana, Mississippi and Tennessee.

- Primary Care Development Corporation – Provides loans and technical assistance for healthcare providers across the U.S. to update and expand operations in order to better serve their patients.

- Rural Community Assistance Corporation (RCAC) – Helps rural communities in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming improve community infrastructure.

- Rural LISC – Works to equip rural areas with capital, strategy, and technical assistance to preserve and strengthen rural life across the United States.

What are some strategies for seeking out capital funding?

Seek out federal assistance:

- Contact state and regional offices to discuss the project.

- State USDA offices – Ask about grants, loans, loan guarantees, and Intermediary Re-lenders. State offices may be able to provide you with examples of successful capital projects in the state.

- Economic Development Administration regional offices

- Contact technical assistance centers to request help.

- Administration for Native Americans – Project planning and development, pre-application training, and pre-application technical assistance.

- HUD Office of Technical Assistance (OTA)

Seek out local and regional assistance:

- Search for commissions, authorities, and/or planning agencies in your state/service region. Ask

about grant opportunities, revolving loan funds, training, networking opportunities, and ideas for

potential funders. (Use Google to search for the key words "regional commission,"

"development authority," "metropolitan planning commission," and your

state.)

- State association members of the National Association of Regional Councils

- U.S. Department of Transportation database of metropolitan planning organization (MPOs)

- Contact county and municipal community development and economic development agencies.

- State Housing Finance Agencies

- Local/state level nonprofit resource centers – Search for association members of the National Council of Nonprofits. They typically offer in-person and virtual training opportunities and other resources on multiple topics relevant to nonprofit organization operations and fundraising. They may be able to point you in the direction of other funding and networking resources.

- Businesses and corporate giving programs

- Look at business directories for chambers of commerce in your retail catchment area. Search for national companies with a local presence, then look for corporate giving programs.

- Corporations headquartered in the state – Ask about giving and community responsibility programs.

- Look for community foundations that serve your area. Discuss the project and ask about grant funds and ideas for potential funders.

- Search for other foundation funders – Contact local members of the Candid Funding Information Network. Begin your

search with

a focus on:

- Foundations headquartered in the state

- Foundations with a history of giving in the state/region

- Work backwards – Look for organizations that are doing a similar project, and search for where they get their funding.

- Look for lenders and Community Development Financial Institutions (CDFIs) that focus on community

development and serve your state.

- Opportunity Finance Network CDFI Locator

- Treasury Department Updated CDFI List

- CDFI Fund Awards Database – Search for organizations that have received CDFI Fund awards in your area.

- Local Federal Home Loan Bank members that could partner on applications for Community Investment programs.

- Local banks and local, national, and regional private lenders – These types of lenders may be more agile and able to move more quickly than the federal and state finance programs; however, projects with cash flow issues and organizations that have a track record of cash flow issues may not be able to access private lending programs. The cost of capital from traditional private lenders may be more than federal, state, and community development lenders, including higher costs for origination fees and interest rates.

What are some strategies for running a successful fundraising campaign for capital projects?

Capital campaigns are intensive fundraising initiatives that are above and beyond typical operational and project fundraising. They take careful planning, diligent execution, and the ability to engage a broad base of support. Components of successful capital campaigns include:

- Plan well by conducting a feasibility study, creating a budget, determining and solidifying a leadership point person, and/or hiring a consultant.

- Set clear goals and a timeline for short-term and long-term campaign activities, making sure to assign a person to ensure each activity is completed.

- Leverage your assets by engaging schools, community colleges, service clubs, organizations, businesses, and tourist traffic in the campaign.

- Gain local support by forming steering committees, executing an outreach strategy, preparing a case statement that connects the project to tangible community improvements, soliciting donations from local donors, and engaging volunteers.

- Have a kick-off event in which you announce funding goals and advanced gifts, begin to solicit larger funding sources, and talk about how the project will impact the community.

- Focus on storytelling by using narratives to build emotional connections, turning data into relatable human experiences that inspire a call to action.

- Communicate gratitude by continuously and meaningfully thanking donors, volunteers, and team members for their support — publicly and privately, out loud and in writing. Be meticulous in offering communications on campaign progress with your supporters.

What is a capital stack, and how do you build one?

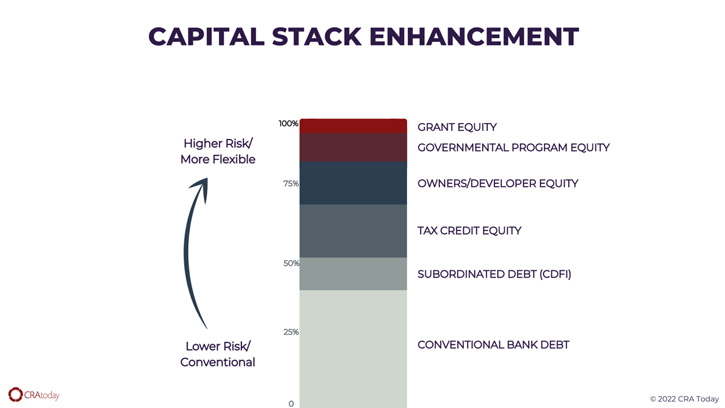

A capital stack is essentially the financial structure of a project – the building blocks that work together to fund a capital project. As shown in the image below, a capital stack may be made up of grants, government funding, conventional loans, subordinated loans, and different types of equity.

There are many ways to build a capital stack that works for your project. Some examples are provided on Capital Link's client case studies page. Case studies were supported by the Health Resources and Services Administration (HRSA) of the U.S. Department of Health and Human Services (HHS).

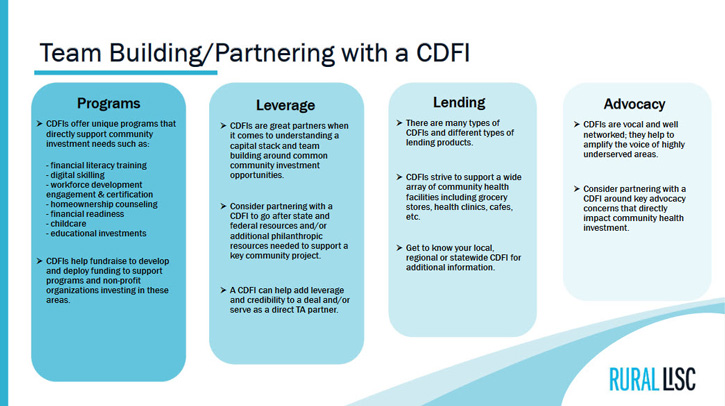

Rural facilities and health and human services providers may lack the capacity to build complex capital stacks. National intermediary CDFIs are in a good position to provide assistance in this area, as shown in the image below.

Intermediary CDFIs that may be able to provide assistance with building a capital stack include:

- Rural LISC

- Enterprise Community Partners

- Oweesta Corporation

- Community Health Center Capital Fund

- CDFI Locator

Are there funding programs that specifically support electronic health record implementation or telehealth projects in rural healthcare facilities?

In addition to the grant programs listed above, there are a number of funding programs that offer grants specifically for electronic health records, health information technology, and telehealth projects, including:

- Healthcare Connect Fund – Universal Services Administrative Company (USAC) program which provides funding to healthcare providers for telecommunications and internet access services, as well as network equipment at a discounted rate.

- Distance Learning and Telemedicine Grant Program – USDA Rural Development program which provides funding to purchase and install equipment for telemedicine and distance learning programs.

- Telecommunications Infrastructure Loans and Loan Guarantees – USDA Rural Utilities Service program that provides financing for telephone and broadband infrastructure in rural areas.

- Community Connect Broadband Grant Program – USDA Rural Utilities Service program that funds broadband deployment into rural communities where it is not yet economically viable for private sector providers to deliver service.

- Small Hospital Improvement Grant Program (SHIP) – Federal Office of Rural Health Policy (FORHP) program which provides grants to State Offices of Rural Health on behalf of small rural hospitals in each state. Among other things, these funds may be used to purchase health information technology (HIT) equipment. For program information and application, contact your State Office of Rural Health.

There may be other types of funding offered at your state or local level — see Funding and Opportunities by Topic: Capital Funding. RHIhub also offers free customized funding searches — email info@ruralhealthinfo.org for assistance.

What are State Health Facilities Finance Authorities, and how can they help with capital funding?

Many states have State Health Facilities Finance Authorities, which issue tax-exempt bonds and pool loans as well as other programs, such as capital planning assistance. Organizations with strong historical performance and/or with general obligation tax support can access "non-rated" bond financing.

For further information, contact your state health facilities finance authorities program. The National Association of Health and Educational Facilities Finance Authorities (NAHEFFA) provides a state-by-state listing of its member authorities. In most cases, an organization will need to hire a municipal advisor to work through a bond deal. For additional information, consult the Municipal Securities Rulemaking Board.